Bitcoin Q2 dip similarities 'uncanny' as Coinbase Premium flips green

Cointelegraph

2025-08-26 23:10:42

Key points:

Bitcoin is “getting closer” to its next local bottom after a trip below the $109,000 mark.

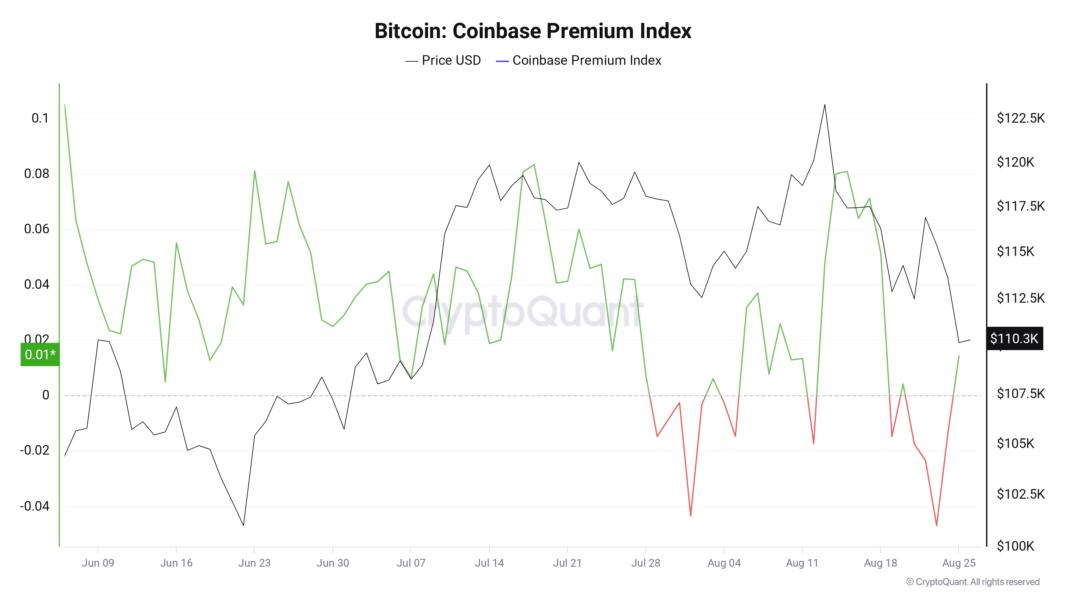

A positive Coinbase Premium returns, raising hopes of a US demand recovery.

ETF flows end Monday positive in a surprise comeback despite the BTC price downside.

Bitcoin consolidated around $110,000 at Tuesday’s Wall Street open amid signs of a crypto market recovery.

Coinbase Premium rebound follows $700 million liquidation

Data from Cointelegraph Markets Pro and TradingView showed BTC price volatility cooling after a fresh round of losses.

These had resulted in a wave of crypto long liquidations worth over $700 million for the 24 hours to the time of writing, per data from CoinGlass.

bottomed at $108,717 on Bitstamp, below old all-time highs seen at the start of the year.

Amid fears of a $100,000 support retest or worse, some market participants saw reason for optimism.

“BTC is now getting closer to the bottom,” popular trader BitBull wrote in part of his latest X analysis.

“There is still a chance of $106K-$108K level retest, but for now I'm expecting a bounceback.”

BitBull referenced encouraging signals from the US, where the Coinbase Premium Index reentered positive territory on Tuesday.

The Index measures the difference in BTC prices between the Coinbase and Binance pairs, and when green, it implies strengthening US market demand.

“Coinbase Bitcoin Premium turned positive during bottom and long liquidations were huge. This shows that max. pain is here and a short rally is expected,” BitBull concluded.

Others also expected a rebound, with fellow trader Mister Crypto seeing a short squeeze next thanks to a significant build-up of short positioning above $115,000 on exchange order books.

Analyst: Bitcoin in “uncanny” Q2 rerun

Elsewhere, Cas Abbe, a contributor at onchain analytics platform CryptoQuant, suggested that current price action is, in fact, familiar.

Bitcoin, he noted, had behaved similarly during a retracement in June, when reached all-time highs of $112,000 before dropping to around $98,000.

“BTC chart resemblance to Q2 2025 fractal is uncanny. Similar lower-lows and a capitulation which forced everything to think ‘it's over,’” he commented on the day.

An accompanying chart underscored the similarities.

In common with previous price drawdowns, institutional flows added to souring sentiment, with analytics resource Ecoinometrics drawing attention to the US spot Bitcoin exchange-traded funds (ETFs).

“The macro uncertainty of the past few weeks is showing up directly in the flows,” it concluded, adding that ETF outflows were “pulling Bitcoin lower.”

On Monday, the ETFs nonetheless achieved positive flows of just under $220 million, per data from UK-based investment firm Farside Investors.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

最新快訊

ChainCatcher

2025-08-27 14:17:28

ChainCatcher

2025-08-27 14:10:00

ChainCatcher

2025-08-27 14:02:42

ChainCatcher

2025-08-27 14:00:50

ChainCatcher

2025-08-27 14:00:02