BlackRock and Ethereum Drive Crypto Inflows to $3.75 Billion

Beincrypto

2025-08-18 17:52:04

Crypto inflows surged last week, exceeding the one before sixfold. Amidst the capital influx into digital asset investment products, two names dominated the charts: BlackRock and Ethereum.

It marks a steady series of positive flows, driving assets under management (AuM) to an all-time high (ATH) of US$244 billion.

Crypto Inflows Surge Sixfold as BlackRock and Ethereum Lead

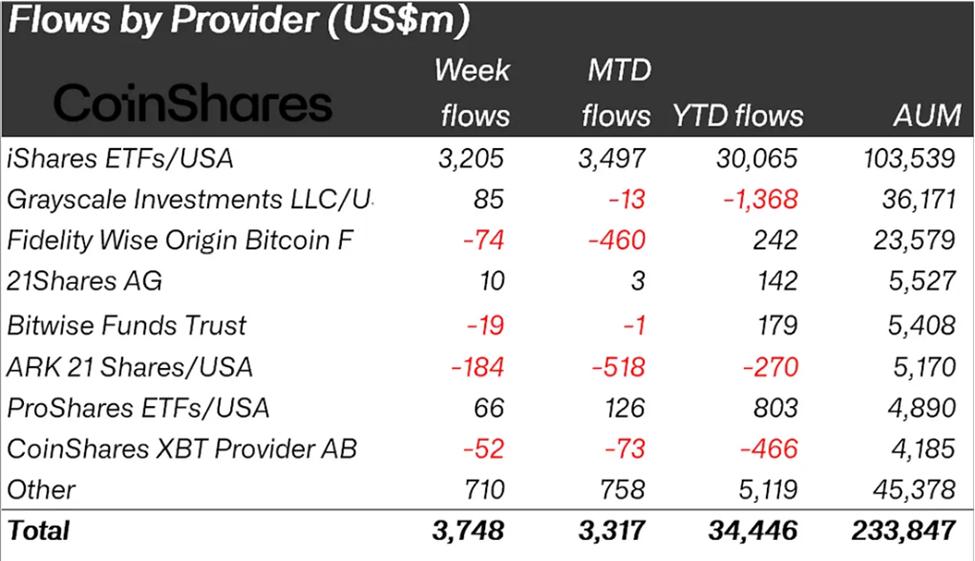

According to the latest CoinShares report, crypto inflows soared to $3.75 billion in the week ending August 16. Compared to the week ending August 9, when crypto inflows reached $578 million, this marked a 6.4x increase.

CoinShares’ head of research, James Butterfill, highlights last week’s crypto inflows as the fourth-largest on record. He also lauds it as a strong rebound after several weeks of tepid sentiment, as revealed in recent CoinShares reports.

Nevertheless, as crypto inflows soared to $3.75 billion, BlackRock’s iShares was an outlier, accounting for the lion’s share of the flows. With up to $3.2 billion in positive flows to the financial instrument, BlackRock’s financial instrument brought in over 86% of last week’s crypto inflows.

“Unusually, almost all inflows were concentrated in a single provider, iShares, and one specific investment product,” read an excerpt in the report.

BlackRock’s dominance comes as its financial vehicle, iShares, remains one of the most popular instruments offering institutional investors access to crypto indirectly.

For perspective, Harvard University, one of the world’s most prestigious institutions of higher learning, chose BlackRock’s IBIT ETF (exchange-traded fund) as its gateway into the crypto market.

In the same tone, recent reports indicated that 75% of BlackRock’s Bitcoin ETF customers were first-time buyers. This points to the asset manager’s allure and the confidence level it inspires even among novice players.

Barely a month ago, BlackRock’s Ethereum ETF inflows surpassed its Bitcoin fund. The turnout explains why BlackRock’s dominance in crypto inflows comes in tandem with Ethereum’s heft.

Ethereum Contributed 77% To Last Week’s Crypto Inflows

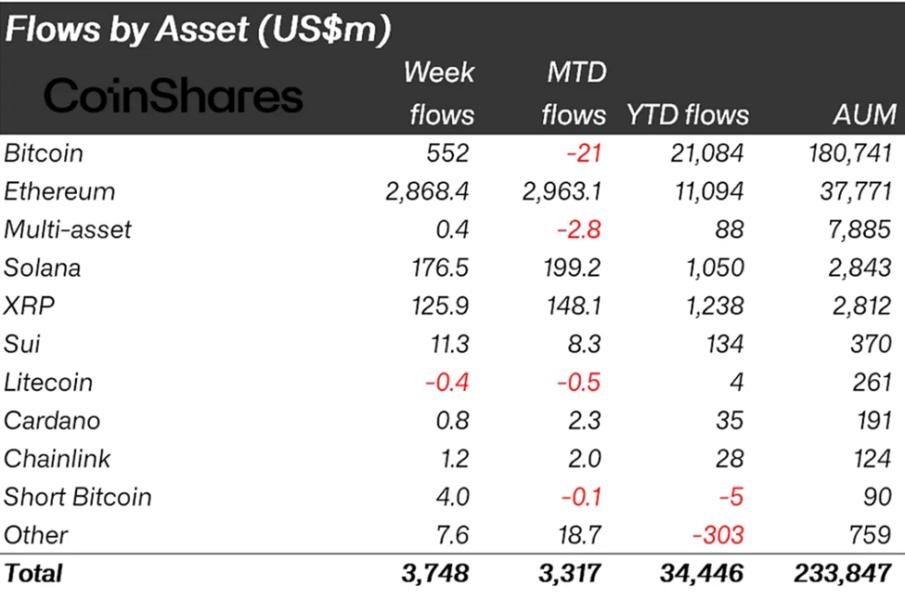

While BlackRock accounted for over 86%, Ethereum was also a significant player, bringing in 77% of total weekly inflows.

“Ethereum continues to steal the show, with inflows totalling a record US$2.87bn last week…the inflows far outstrip Bitcoin, with YTD inflows representing 29% of AuM compared to Bitcoin’s 11.6%,” Butterfill added.

Notably, Bitcoin saw modest inflows in comparison to Ethereum, bringing in $552 million in positive flows.

It adds to the series of weeks Ethereum has dominated crypto inflows on asset metrics, effectively outshining Bitcoin. Among other instances, Ethereum recently propelled crypto inflows to a record $4.39 billion weekly high.

Over the past several weeks, investor sentiment has been favoring Ethereum over Bitcoin. The attention drew tailwinds from the recent frenzy around Ethereum, catalyzed by institutions adopting ETH-based corporate treasuries.

Tokenized assets also soared to a $270 billion record as institutions progressively standardize on Ethereum.

Against this backdrop, analysts say the Ethereum price may be on course to reach the $5,000 milestone, nearly 20% above current levels.

最新快訊

ChainCatcher

2025-08-24 02:03:27

ChainCatcher

2025-08-24 02:03:23

ChainCatcher

2025-08-24 01:38:02

ChainCatcher

2025-08-24 00:48:49

ChainCatcher

2025-08-24 00:25:38